How profitable to take a loan

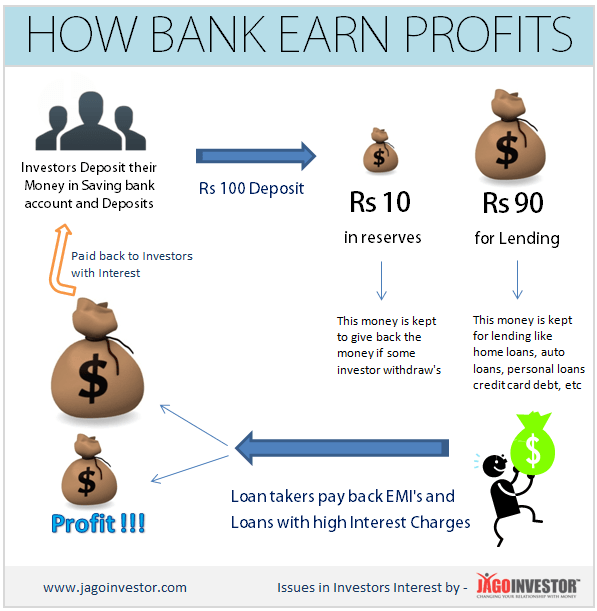

Taking a loan can be a profitable decision for many individuals and businesses. Whether it's for personal reasons or to support the growth of a business, loans can provide the necessary funds to achieve various goals. Here are some reasons why taking a loan can be profitable:

Investment Opportunities: Loans can offer the chance to invest in lucrative opportunities that have the potential for high returns. For example, a business might need funding to purchase new equipment or expand its operations. By taking a loan, they can seize these opportunities and generate increased revenue, making the loan profitable in the long run.

Time-Sensitive Situations: In certain situations, time is of the essence, and waiting to accumulate enough funds may not be feasible. Taking a loan allows individuals or businesses to act quickly and take advantage of time-sensitive opportunities. This could include purchasing limited-time offers, participating in time-limited sales, or covering unexpected expenses.

By capitalizing on these situations, loans can result in profitable outcomes.

Cash Flow Management: Loans can be valuable for managing cash flow, especially for businesses. There might be times when a business faces temporary cash shortages due to delayed payments from clients or seasonal fluctuations. In such cases, taking a short-term loan can help bridge the gap and ensure smooth operations.

By maintaining uninterrupted cash flow, businesses can continue their operations, fulfill orders, and prevent loss of customers, thus making the loan worthwhile.

Consolidating Debt: In certain instances, taking a loan to consolidate existing debt can lead to financial benefits. If an individual or business has multiple loans or high-interest debts, combining them into a single loan with a lower interest rate can save money on interest payments. This approach allows for more efficient debt management and can ultimately lead to long-term savings.

Building Credit History: For individuals or businesses with limited credit history, taking a loan and repaying it responsibly can be an effective way to build a positive credit profile. Establishing a solid credit history opens doors to better loan terms, lower interest rates, and increased financial opportunities in the future. This can result in significant savings over time and make borrowing more profitable.

Tax Benefits: In some cases, the interest paid on certain types of loans can be tax-deductible. This means that borrowers can reduce their taxable income by deducting the interest paid, resulting in potential tax savings. Consulting with a tax professional can help identify eligible deductions and ensure the maximum benefit is derived from the loan.

It is important to note that taking a loan requires careful consideration and planning. Borrowers should assess their financial situation, repayment ability, and the terms of the loan before making a decision. It's essential to choose a reputable lender, compare interest rates and fees, and evaluate the impact of the loan on overall financial health.

While loans can provide profitable opportunities, they also come with risks. Borrowers must be diligent in making timely payments to avoid accruing excessive interest or damaging their credit score. Responsible borrowing and sound financial management are crucial for ensuring that a loan remains profitable in the long term.