What you need to know about buying an apartment with a mortgage

Buying an apartment with a mortgage is a significant financial decision that requires careful consideration and planning. It is essential to understand the key aspects involved in this process to make an informed choice. Here are some important things you need to know when buying an apartment with a mortgage.

Firstly, it's crucial to assess your financial situation before embarking on the home-buying journey. Calculate your budget and determine how much you can afford to spend on a monthly mortgage payment. Consider your income, expenses, and any other financial obligations you may have.

This evaluation will give you a realistic idea of what you can comfortably afford and prevent you from taking on too much debt.

Next, you should check your credit score. Lenders use credit scores to assess your creditworthiness and determine the interest rate on your mortgage. A higher credit score can lead to more favorable loan terms, including lower interest rates. If your credit score is lower than desired, take steps to improve it before applying for a mortgage.

Paying bills on time, reducing debt, and avoiding new credit applications can help improve your credit score over time.

Once you have a clear understanding of your budget and credit score, you can start shopping for a mortgage. Research different lenders and loan options to find the one that best suits your needs. Compare interest rates, loan terms, and any additional fees or charges associated with the mortgage.

Don't hesitate to ask questions and seek clarification from lenders to ensure you fully understand the terms and conditions of the mortgage.

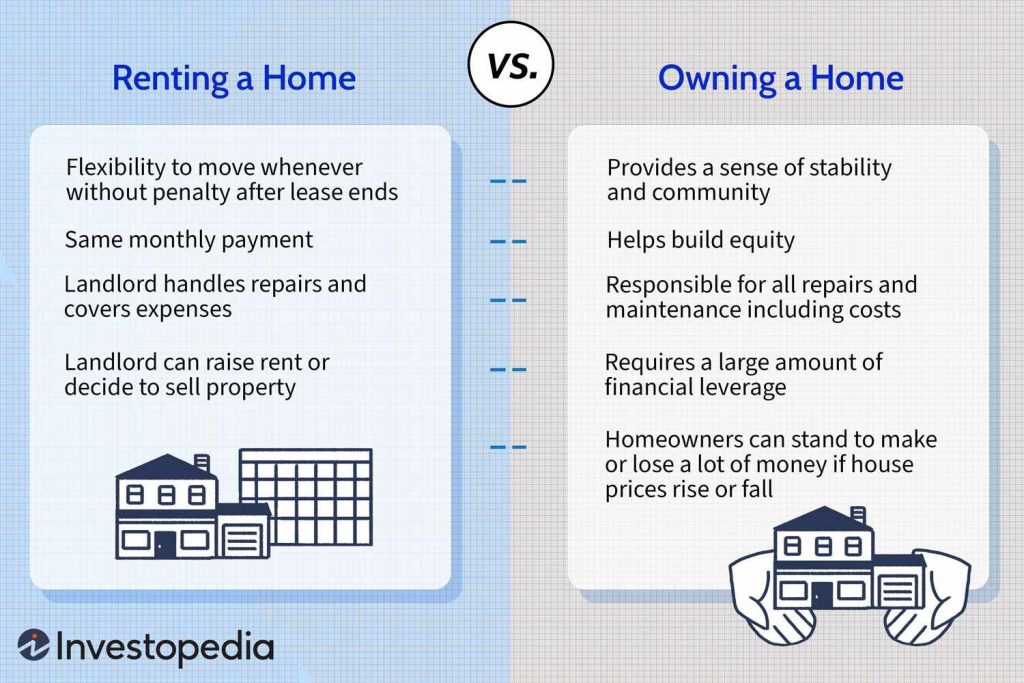

It is also essential to consider the down payment required for the apartment purchase. A larger down payment can help reduce the overall loan amount and lower your monthly mortgage payments. Aim to save as much as possible for the down payment before buying an apartment.

Additionally, be aware of any other upfront costs, such as closing costs and fees, that may be involved in the home-buying process.

During the mortgage application process, you will need to provide necessary documentation, including proof of income, employment history, bank statements, and tax returns. Prepare these documents in advance to expedite the application process and ensure a smoother transaction.

Once your mortgage application is approved, it's time to finalize the purchase. Consider hiring a professional home inspector to assess the apartment's condition and identify any potential issues or repairs needed. This inspection can help you make an informed decision and negotiate repairs or adjustments with the seller if necessary.

Lastly, be prepared for the responsibilities that come with homeownership. Owning an apartment means you are responsible for maintenance, repairs, and associated costs. Factor these expenses into your budget to ensure you can handle them comfortably along with your monthly mortgage payments.

Buying an apartment with a mortgage can be a fulfilling and exciting milestone. By understanding your financial situation, researching loan options, and being prepared for the responsibilities of homeownership, you can make a well-informed decision and enjoy the benefits of owning your own home. Take your time, seek professional advice if needed, and make a choice that aligns with your long-term financial goals.